Is Filing Chapter 7 Better Than Filing Chapter 13?

Which is better? Chapter 7 Bankruptcy or Chapter 13?

Should you File Chapter 7 or Chapter 13 Bankruptcy?

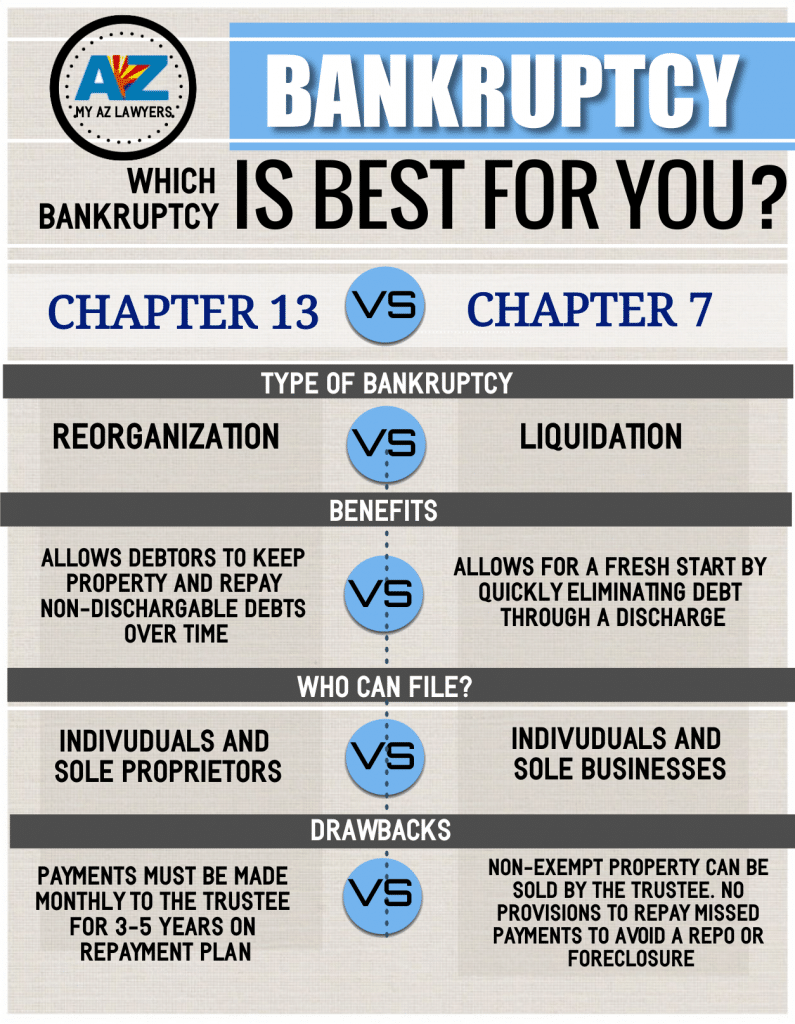

The Arizona bankruptcy law is complicated. Both Chapter 7 and Chapter 13 have distinct components that help solve specific debt problems. Basically, a Chapter 13 requires debt to be repaid through a payment plan, and a Chapter 7 wipes out qualifying debt.

Therefore, the specifics of both Chapter 7 and 13 are best left to an experienced Arizona bankruptcy lawyer. Thus, after a debt evaluation, an attorney can help determine the best course of action. Plus, inform you which bankruptcy is best to pursue. Thus, there are reasons why a Chapter 13 bankruptcy would be more beneficial than a Chapter 7, and vice-versa.

Why You May Consider a Chapter 13 Bankruptcy

Whereas, If you do not qualify for a Chapter 7 bankruptcy, a Chapter 13 is an option. Through calculations of monthly, median, and disposable incomes we access a means test to see if you qualify. Therefore, through a means test determination is made to see if you are able to pay back some of the debt through a repayment plan by filing Chapter 13. Thus, the means test includes some complex regulations. So, to know how the bankruptcy law determines your bankruptcy options, consult with My AZ Lawyers. Also, before making important decisions about your debt and financial future, consult with an attorney experienced in representing Arizona residents in bankruptcy court. My AZ Lawyers bankruptcy team will help you understand the means test and every option you may have concerning your debt relief.

Trust My AZ Lawyers to provide expert legal representation for your bankruptcy

My Arizona Lawyers not only can help you make the best decisions regarding your debt, but also handle the court documents, paperwork, and scheduling. Our Arizona bankruptcy attorneys have successfully represented Arizona residents in bankruptcy court. We maintain a reputation for professional, affordable legal service because our team knows the Arizona bankruptcy law, the courts, the trustees, the judges, and the bankruptcy process in its entirety.

Chapter 7 Bankruptcy vs. Chapter 13 Bankruptcy. Which Should you Choose?

In Arizona, there are two main types of consumer bankruptcies available for individuals to file. The 2 most popular chapters of bankruptcy are chapter 7 bankruptcy and chapter 13 bankruptcy. Thus, the majority of people file chapter 7 bankruptcy, followed distantly by chapter 13 bankruptcy filings. Both types of bankruptcy are great forms of debt relief.

Differences between Chapter Seven and Chapter Thirteen Bankruptcy

The differences between chapter seven and chapter thirteen bankruptcy are many. One of the main differences is that ch 7 bankruptcy discharges your obligation to pay most of you unsecured debts. Conversely, a Chapter 13 bankruptcy in Arizona allows you to repay your secured debts over time through a payment plan.

A chapter 13 bankruptcy is best for preventing creditors from repossessing secured property on which you are making payments. Thus, regardless of the type of bankruptcy you want, there are many requirements, obligations and rules which you need to follow. Also, the best way to learn which bankruptcy is right for you is to contact an experienced chapter 7 or chapter 13 bankruptcy attorney. Additionally, hiring a dedicated chapter 7 or chapter 13 bankruptcy lawyer not only helps you make the correct choice in choosing a bankruptcy chapter, it also ensures that you receive the anticipated debt relief. Therefore, please contact our Phoenix bankruptcy attorneys today.

When is Filing Chapter 13 more advantageous than Chapter 7?

Let’s say you do qualify for Chapter 7. How do you know which bankruptcy protection is the best choice for your particular debt situation? Keep in mind, there may be some circumstances in which debt is best managed through filing Chapter 13. Therefore, if you have debt such as a tax obligation, outstanding child support, or other non-dischargeable debt, the Chapter 13 repayment plan may allow you to pay the debt over several years.

In order to keep a car or a home, a Chapter 13 bankruptcy allows you to make up missed payments over an agreed period of time. Also, Chapter 13 bankruptcy protection gives a debtor extended time to repay debts. Thus, after a Chapter 13 is filed, an automatic stay is put into place, which means all debt collection actions by creditors must stop. Additionally, a creditor, once a bankruptcy is filed, may not garnish wages, foreclose, repossess, proceed with a lawsuit, or demand funds from your bank account. Therefore, this order grants the opportunity to create the extra time needed to pay back debt.

Arizona recognizes exemptions in a bankruptcy. If you have nonexempt property that you wish to keep, you may want to opt for a Chapter 13 bankruptcy. In a Chapter 7, you are allowed only to keep exempt property. These exemptions are protected from creditors. My AZ Lawyers will sit down with you and go through your debt concerns and devise a strategy which will best fit your financial needs. In short, Chapter 13 may be an option if you have property that is nonexempt and are able to repay debt through a 3-5 year repayment plan.