Mesa Bankruptcy Lawyers

Debt Relief Law Firm in Mesa, Arizona

Our Mesa Bankruptcy Lawyers can assist you with filing for chapter 7 bankruptcy, chapter 13 bankruptcy, or another needed form of debt relief. Our attorneys can also assist you with stopping a wage garnishment, saving your home from a foreclosure, or getting you out of a vehicle repossession.

✓Mesa Bankruptcy Lawyers will help you rebuild your credit.

✓Filing Chapter 7 or Chapter 13 will allow you to stop bad financial habits.

✓Our bankruptcy law office can give you the ability to pay your current bills on time.

✓Live your life without worry after declaring bankruptcy.

✓Bankruptcy filing gives you legal protection from creditors and debt collectors.

Our Mesa bankruptcy lawyers provide Mesa residents the personal legal representation and help to protect assets, stop creditor harassment, a find a fresh financial beginning.

Mesa Bankruptcy Service

4065 E University Dr #500, Mesa, AZ 85205

MESA BANKRUPTCY FREQUENTLY ASKED QUESTIONS

Mesa Bankruptcy Attorneys

Our Mesa bankruptcy lawyers provide our clients, both large and small, with the highest quality debt relief representation and bankruptcy help. The Mesa debt relief law firm offers the customer service typically only associated with larger bankruptcy firms, but with the personal service, attention and responsiveness of a smaller firm and local Mesa attorneys.

Trusted, Dedicated, Experienced Debt Relief Attorneys

The dedicated Mesa Bankruptcy Attorneys at Mesa Bankruptcy Lawyers, are well known for the great customer service with which they represent their clients. The entire Mesa debt relief team enjoy using Arizona bankruptcy law to eliminate their clients’ debts and to help them get a “fresh start.” Additionally, they also advise and counsel their Mesa, Arizona clients on how to rebuild their credit after bankruptcy. Plus, our Mesa bankruptcy attorneys derive real satisfaction from protecting financially pressed individuals in Mesa, Arizona. We strive to fight against the high interest credit card companies and predatory lenders that harass the good people of Mesa. Let our Experienced Mesa attorneys and Dedicated Mesa Lawyers end the creditor harassment and alleviate your debt.

Why Choose Our Mesa Bankruptcy Law Firm?

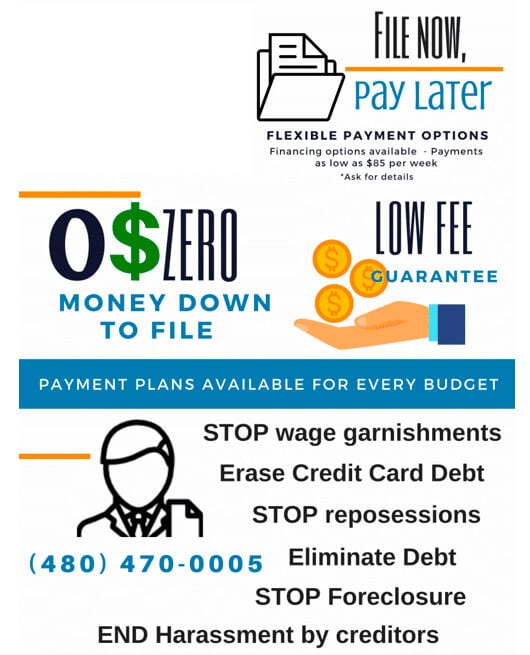

Also, our Mesa bankruptcy attorneys understand clients deserve more attention and hands on time from their Mesa, AZ bankruptcy attorney. Many large bankruptcy firms are unable to dedicate their time due to high volume. Plus at Mesa Bankruptcy Lawyers, our bankruptcy clients are given ample time and opportunity to address all questions and concerns they may have regarding their possible bankruptcy filing. Additionally, we offer Free (1/2) one half hour consultations with our Mesa bankruptcy lawyers. We will not hurry you out the door! Our Mesa bankruptcy Attorneys offer some of the lowest legal rates in all of Arizona. We match or beat the legal fees of our competitors.

Filing Chapter 7 in Mesa, Arizona

Our bankruptcy attorney firmly believe everyone deserves a second chance and a “Fresh Start”. If filing chapter 7 bankruptcy or chapter 13 bankruptcy is the answer, our experienced bankruptcy attorneys will advise you to what is the best financial option for you and your family.

Filing Chapter 13 Bankruptcy in the city of Mesa

Bankruptcy is our practice, our expertise

Our Mesa bankruptcy lawyers take great pride in being available to our clients, whether it is in person, by phone, or via electronic mail. Our attorneys for bankruptcy offer convenient locations, night and weekend appointments, combined with fast, friendly service. Our Mesa AZ attorneys for filing bankruptcy can start your Chapter 7 or Chapter 13 with little or no money down. Contact one of our experienced Mesa bankruptcy lawyer AZ today for a FREE consultation.

Second Chance Through Bankruptcy

The bankruptcy laws are designed to give you a chance at a “Fresh Start” and renewed financial freedom. Overwhelming debts do not have to control your life! You can take back control of your finances and stop creditor harassment, stop creditor calls, stop wage garnishments, stop vehicle repossessions, and foreclosures. Isn’t it time you were able to answer the telephone again and open your mail without fear of aggressive actions by collection agencies? There is no better time than now to improve your quality of life, stop threatening collections, and get your life back on track. The bankruptcy lawyers at Mesa Bankruptcy Lawyers can help get your life back on track and get you on the road to financial freedom.

Bankruptcy in Mesa Benefits.

There are several benefits yielded from filing for a bankruptcy. Filing doesn’t necessarily mean that you’ll lose everything you have. Contrarily, through filing and completing a bankruptcy report, you stand to gain flexibility from the staggering debt and anxiety you’ve been encountering each and every day since you’ve been bombarded with these debts. You gain relief and peace of mind from those aggressive and consistent creditor calls as well as impending all creditor lawsuits against you.

Knowledgeable Bankruptcy Guidance in Mesa, Arizona

While many Mesa Bankruptcy Lawyers don’t ever meet directly with their clients, the Mesa debt relief team at Mesa Bankruptcy Lawyers meet with every client personally. Plus, our clients meet with one of our experienced bankruptcy lawyers and work with the attorney every step of the way while filing for chapter 7 or chapter 13 bankruptcy in Mesa, Arizona. Additionally, you get knowledgeable bankruptcy guidance from an attorney when working with our Mesa bankruptcy law firm.

The close working relationship between attorney and client assists us in knowing each case well. Our Mesa bk lawyers pride themselves on doing what’s right for each client’s situation. Making the right decision for each client makes a difference. These differences factor in the cost of your bankruptcy and the length of time you’ll have to deal with the Arizona bankruptcy courts and your creditors. Your situation is unique to you, your debt relief solution should be too.

Let our knowledgeable bankruptcy guidance work for you.

Mesa Bankruptcy Lawyers makes all the needed steps and procedures towards bankruptcy and helps you turn your life from a debt-loaded and never-ending paycheck to paycheck cycle and into a debt-free lifestyle. They accomplish this through their skilled and trained bankruptcy lawyers and customer friendly staff. Get yourself on the road to financial freedom today. Give our Mesa bankruptcy attorneys a call today.

Filing bankruptcy with our Mesa bankruptcy law firm has benefits:

•Debt Relief will help you rebuild your credit score.

•You will be working directly with our Mesa bankruptcy lawyers every step of the way.

•Filing Chapter 7 bankruptcy or Chapter 13 bankruptcy will allow you to stop bad financial habits.

•Our Mesa bankruptcy law office can give you the ability to pay your current bills on time.

•Not only will we help you alleviate your present debt. We will help you build your future credit and get you a “Fresh Start”

•Live your life without worry after declaring bankruptcy.

•Bankruptcy filing gives you legal protection from creditors and debt collectors.

Mesa, Arizona Bankruptcy Office

Affordable Bankruptcy Services For Mesa AZ

When you need experienced legal representation from an affordable bankruptcy lawyer in Mesa, Arizona to best help resolve your legal issues, Mesa Bankruptcy Lawyers can help. Be it bankruptcy filing, Chapter 7 bankruptcy, Chapter 13 bankruptcy, wage garnishments, repossessions, estate planning attorney, debt settlement, wills, trusts, bankruptcy lawyer assistance, divorce, family law, contract review, contract drafting, or foreclosure law, the experienced bankruptcy attorneys at our Mesa law office can assist any of these legal needs. Our Mesa bankruptcy lawyers have assisted thousands of people in Mesa and throughout Arizona file for bankruptcy protection.

Chapter 13 Bankruptcy and Chapter 7 Bankruptcy Lawyers in Mesa, AZ

Chapter 7 and Chapter 13 bankruptcy attorneys

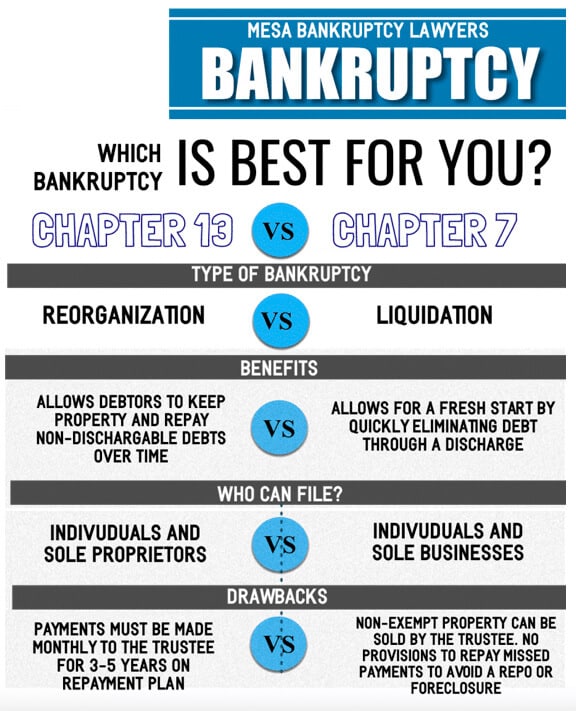

While Chapter 7 in Mesa is a quicker “fresh start” (usually 5 to 7 months start to finish), Chapter 13 bankruptcy is a longer process. The typical chapter 13 bankruptcy lasts 3-5 year. However, the length of the chapter 13 bankruptcy depends entirely on your specific situation. Sometimes your bankruptcy case can be longer and sometimes shorter.

In a chapter 7 bankruptcy there is usually only 1 court hearing which is called a “341 Hearing” or a “Meeting of Creditors”. It is a short hearing and may be the only hearing required in a Mesa Chapter 7 bankruptcy filing. When the court sets your payments, you are required to make those payments. Over the term of the Chapter 13, there will be hearings that are very quick and informational. Our Mesa bankruptcy lawyer will be with you at every court hearing as you work through the process of filing for bankruptcy in Arizona.

Chapter 7 or Chapter 13 Bankruptcy – Which is the Best Chapter for You?

Filing chapter 7 bankruptcy or chapter 13 bankruptcy in Mesa and Arizona is this country’s consumer protection law and is a perfect debt remedy for these challenging economic times. In the hands of experienced Mesa bankruptcy lawyers, debt relief law offers many different avenues to help consumers. Determining the best solution for you will be based on your financial goals and legal options. Debt consolidation, Chapter 7 bankruptcy, and chapter 13 bankruptcy are solutions available to most consumers even under the 2005 bankruptcy law revisions.

Chapter 13 Bankruptcy and Chapter 7 Bankruptcy Lawyers in Mesa, AZ

Chapter 7 and Chapter 13 bankruptcy attorneys

While Chapter 7 in Mesa is a quicker “fresh start” (usually 5 to 7 months start to finish), Chapter 13 bankruptcy is a longer process. The typical chapter 13 bankruptcy lasts 3-5 year. However, the length of the chapter 13 bankruptcy depends entirely on your specific situation. Sometimes your bankruptcy case can be longer and sometimes shorter.

In a chapter 7 bankruptcy there is usually only 1 court hearing which is called a “341 Hearing” or a “Meeting of Creditors”. It is a short hearing and may be the only hearing required in a Mesa Chapter 7 bankruptcy filing. When the court sets your payments, you are required to make those payments. Over the term of the Chapter 13, there will be hearings that are very quick and informational. Our Mesa bankruptcy lawyer will be with you at every court hearing as you work through the process of filing for bankruptcy in Arizona.

Chapter 7 or Chapter 13 Bankruptcy – Which is the Best Chapter for You?

Filing chapter 7 bankruptcy or chapter 13 bankruptcy in Mesa and Arizona is this country’s consumer protection law and is a perfect debt remedy for these challenging economic times. In the hands of experienced Mesa bankruptcy lawyers, debt relief law offers many different avenues to help consumers. Determining the best solution for you will be based on your financial goals and legal options. Debt consolidation, Chapter 7 bankruptcy, and chapter 13 bankruptcy are solutions available to most consumers even under the 2005 bankruptcy law revisions.

Mesa Bankruptcy Filing Service

Are you skipping or postponing vacation time with your family and friends because of overwhelming debts? Or, do you wish that you could getaway to the Grand Canyon, go skiing in Flagstaff, or visit London Bridge in Lake Havasu City? Are unexpected circumstances in your life influencing your family plans? Are your finances controlling the life of you and your family?

Bankruptcy Lawyers For Mesa, AZ

There is no need to put your family’s future on hold any longer. Thus, the Mesa bankruptcy lawyers at our firm are here to assist you, our compassionate team of professionals is ready to help you get a fresh financial start. Call us today at (480) 470-0005 so our Mesa Bankruptcy attorneys can begin putting our debt relief strategies to work for you.

Affordable Bankruptcy Law Firm in Mesa, Arizona

Sign up for a free debt relief consultation with one of our experienced, affordable bankruptcy lawyers in Mesa, Arizona. Plus, our debt management specialists can help. Additionally, Mesa Bankruptcy Lawyers services all of Maricopa County and Arizona including the surrounding communities including: Apache Junction, AZ, Chandler, AZ, El Mirage, AZ, Paradise Valley, AZ, Queen Creek, AZ, Scottsdale, AZ, and Tempe, AZ.