Tucson, Arizona Bankruptcy Law Office

Our Bankruptcy Lawyers can help you become Debt Free:

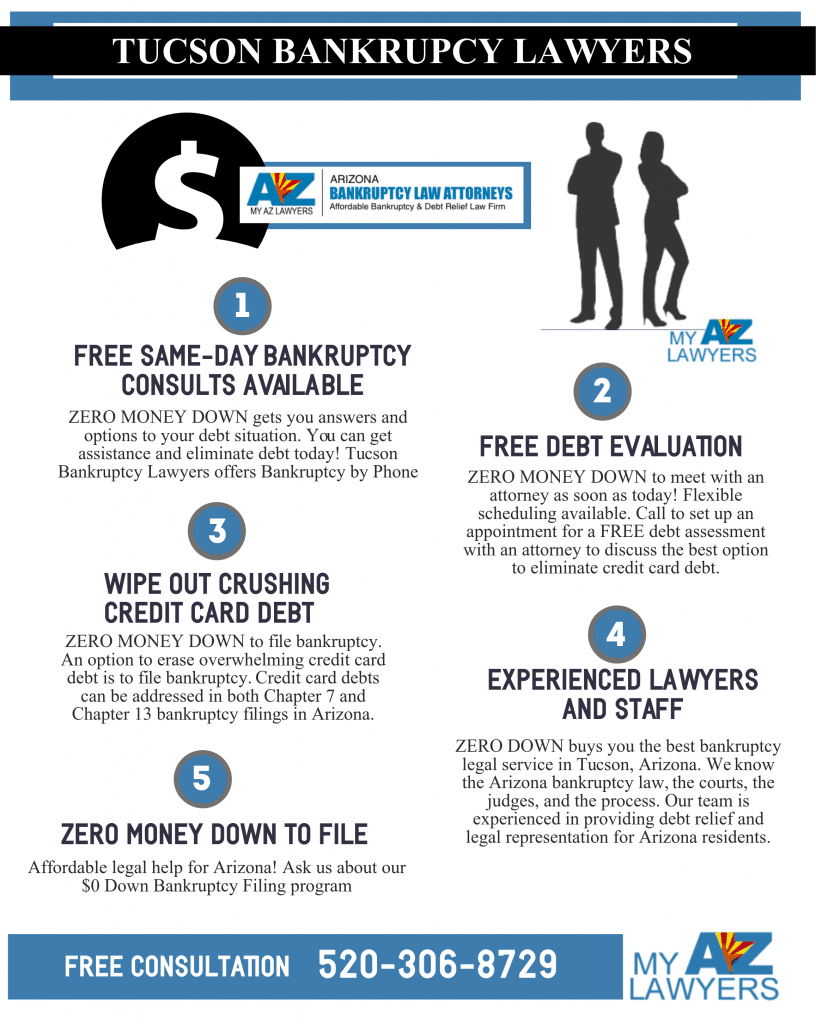

Tucson Bankruptcy Lawyers

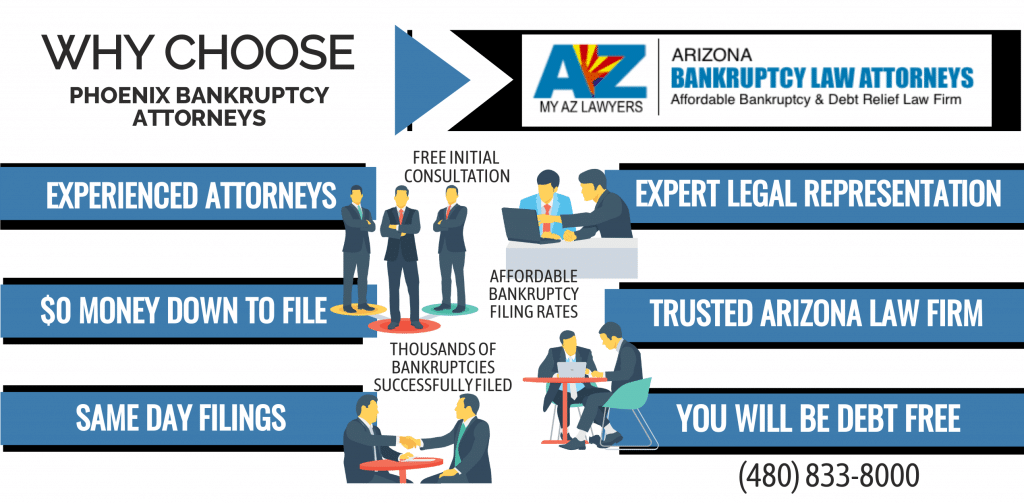

Our Low Cost Tucson Bankruptcy Lawyers will do more than file your bankruptcy. Additionally, our experienced bankruptcy legal team will help you to understand the bankruptcy process, and will assist you in successfully eliminating or reducing debt through Chapter 7 or Chapter 13 bankruptcy. Plus, we believe our debt relief attorneys are the best in Tucson and Pima County. Not only do we offer years of bankruptcy experience, but our team strives on providing superior customer service. All of this while giving the people of Tucson a myriad of debt relief options including: Chapter 7 Bankruptcy, Chapter 13 Bankruptcy, Bankruptcy by Phone, and Zero Down Bankruptcy.

Our Tucson Bankruptcy Lawyers use bankruptcy as a legal tool that residents of Arizona regularly need when they are faced with debt that they cannot pay. So, if you are considering filing for bankruptcy, the Tucson Debt-Relief Lawyers at Arizona Bankruptcy Lawyers can help you get a “Fresh Start” through Filing Chapter 7 or Chapter 13 Bankruptcy with $0 Down. Therefore, filing bankruptcy with our Tucson Bankruptcy Lawyers is just a phone call away and you can file today with no money down.

File Bankruptcy for Zero ($0) Down in Tucson, Arizona

There is no gimmick here! This simply works like this: We review your situation, give you a detailed recommendation, then offer you a payment arrangement that will work ideally for your financial situation.

When we say $0 down, that is exactly what it means. No money out of your pocket and you get financial relief. Zero dollars to make the phone stop ringing with creditor harassment. Zero dollars to stop a wage garnishments that could financially cripple you.

There are so many people who are desperate to get out of debt and desperate for relief, people who could afford a monthly payment in a chapter 13 bankruptcy if they could only get the up-front costs together. We decided that we could help and make it easier to get the means together to file for bankruptcy protection. We simply lowered the amount necessary to file bankruptcy and everyone is benefiting from our $0 Down to file bankruptcy.

CHAPTER 7 BANKRUPTCY WITH MY ARIZONA LAWYERS

For most Chapter 7 cases, we can file your case for $0 in legal fees (you only pay the $335 bankruptcy court filing fee to the bankruptcy court) AFTER filing, you will make low monthly payments for the post-filing work.

CHAPTER 13 BANKRUPTCY WITH MY ARIZONA LAWYERS

For most Chapter 13 cases, we can file your case for little money down in legal fees. (you also pay $310 bankruptcy court filing fee)

The remainder of the attorney fees can usually be paid through your Chapter 13 bankruptcy plan. Plus, payments in a chapter 13 bankruptcy plan may be as low as $100 per month depending on your assets and expenses.

If you qualify for our Tucson $0 down program, you quickly get the help you desperately need immediately. Call us now and get set up for a free consultation with one of our Tucson debt relief attorneys. There is no risk, you get to talk to us for free and get professional advice about your financial situation.

TUCSON, ARIZONA BANKRUPTCY FAQs

Filing for Bankruptcy in Tucson, Arizona

Many people wish that they could get a handle on their debt and stop the creditor calls, repossession attempts, wage garnishments, and bank levies — but many people do not know how to do so. The criteria to file for bankruptcy are actually rather simple; almost anyone in the United States can file. As long as you work with an attorney to prove that your debt is significantly higher than your income or disposable income, bankruptcy may be a good option for you.

When you file, you will begin to reap immediate benefits and you can begin rebuilding your credit right away. Whether you file for Chapter 7 or Chapter 13 bankruptcy, our Tucson bankruptcy lawyers can provide you with trusted representation.

Bankruptcy can benefit you!

Consider the following ways filing bankruptcy can help people in Tucson, Arizona:

- Regain control of financial circumstances

- Immediately stop a garnishment.

- Stop repossession of your property

- Stop the foreclosure process

- Get rid of Payday Loans

Though there are several benefits. The whole idea of declaring bankruptcy still carries a negative stereotype to many people. Gone are the days when debtors’ names were printed in the newspaper. Our Tucson bankruptcy attorneys keep your case completely confidential and secure. Besides your creditors, your attorney, and yourself, no one needs to know that you are filing for bankruptcy. In fact, there are multiple benefits to bankruptcy, including:

- Stopping Creditor Harassment and Calls.

- Eliminating high interest credit card debt.

- Preparing your credit to be re-built the right way.

Chapter 13 & 7 Bankruptcy For Tucson, AZ

Tucson Bankruptcy Lawyers like the ones at the My AZ Lawyers, are recommended when considering chapter 7 or chapter 13. Our skilled legal professionals help clients with every aspect of filing bankruptcy such as: How to choose a qualified lawyer, Steps to filing bankruptcy, the filing process, and life after declaring bankruptcy.

Tucson AZ is home to just over 1 million people, many who are financially struggling and in need of some form of debt relief such as: Chapter 7, Chapter 13, Foreclosure Help, Debt Consolidation, Debt Relief, or Debt Restructuring. Our low cost debt relief specialists can help people in need of debt relief in AZ.

Our Tucson bankruptcy attorney serves all of the city of Tucson and surrounding communities (such as the major incorporated suburbs including Oro Valley and Marana northwest of the city, Sahuarita south of the city) take great pride in being available to our clients, whether it is in person, by phone, or via electronic mail.

Seeking Help from an Experienced Bankruptcy Lawyer is recommended if:

Try Bankruptcy By Phone! Tucson, AZ Bankruptcy Attorneys

The bankruptcy laws are designed to give you a chance at a “Fresh Start” and renewed financial freedom. Overwhelming debts do not have to control your life! You can take back control of your finances and stop creditor harassment, stop creditor calls, stop wage garnishments, stop vehicle repossessions, and foreclosures. Isn’t it time you were able to answer the telephone again and open your mail without fear of aggressive actions by collection agencies? There is no better time than now to improve your quality of life, stop threatening collections, and get your life back on track. The Tucson bankruptcy experts at The My AZ Lawyers can help get your life back on track and get you on the road to financial freedom. Contact our law firm today to schedule your FREE initial consultation.

Rebuilding Your Credit After Bankruptcy

Once you have filed for bankruptcy in Arizona, it is then time to start rebuilding your financial future. Filing for chapter 7 or chapter 13 bankruptcy is not great for your credit score. However, filing bankruptcy may also be the first step in rebuilding your credit. It would be fair to say that you could look at filing bankruptcy in Tucson as a good place to begin your “fresh start”.

If your credit cards are “maxed out” and you are facing wage garnishments, repossessions, legal actions and harassing phone calls and letters from debt collection agencies, your credit score is probably already impaired.

A bankruptcy filing will remain on your credit report for seven to ten years. However, often within a few months of discharge you can start rehabilitating your credit, provided you have sufficient regular income. Within a few years, you may be able to get a mortgage on a home.

Contact Us For A Free Consultation

Our Tucson bankruptcy attorneys offer FREE Consultations (either in person or by phone). Plus, night and weekend consultations by appointment. Additionally, we combine all of it with fast, friendly, compassionate service. Also, our debt relief lawyers can start your Tucson Chapter 7 or Chapter 13 bankruptcy with little or no money down. Therefore, Contact one of our experienced legal professionals today for a FREE consultation.

Our Tucson Bankruptcy Attorney Office

START: James A. Walsh U.S. Courthouse

38 South Scott Avenue

Tucson, AZ 85701

Phone: 520-202-7500

1. Head north on S Scott Ave toward E Congress St 240 ft

2. Take the 1st left onto E Congress St

Destination will be on the left

END: The My AZ Lawyers

2 E. Congress, Suite 900

Tuscon, Arizona 85701

Phone: 520-306-8729

Credit Cards After Bankruptcy in Tucson, Arizona

It is a bankruptcy myth that you aren’t able to get a credit card after filing for bankruptcy. Plus, Credit card companies are happy to give you credit after you have filed for bankruptcy protection as they do not have to worry about you filing for bankruptcy and not paying them back. However, Chapter 7 bankruptcy can only be filed every 8 years and the credit card companies no this fact. Plus, since you just declared bankruptcy and are trying to re-build your credit, the creditors know that you won’t be as apt to do anything (like no paying your credit card bill) to jeopardize your credit.

The other side of the equation would be people who have filed for bankruptcy in Tucson may be hesitant to get new credit cards because those same cards may have been the cause of their bankruptcy filing. However, following Tucson bankruptcy lawyers advice, the prudent use of a credit cards following a bankruptcy can actually help you to improve your credit score. Therefore, getting a secured or non-secured credit card and making the payments on time is a great way to rebuilding your credit score after filing bankruptcy.

Secured Credit Cards

Secured credit cards are an option for people who have recently filed for bankruptcy protection and aren’t able to secure a traditional credit card. Plus, if you aren’t able to get a traditional credit card, don’t worry, there are additional credit card options for people in Tucson that have recently filed for bankruptcy. Therefore, a secured credit card is obtaining a credit card that is backed by cash deposits, or advanced paid fees.

Credit cards after filing for bankruptcy can be of great assistance as after making regular payments on that credit card for a period of time, you may be able to change it to an unsecured or regular credit card. Plus, getting a credit card is a great step to rebuilding your credit after filing bankruptcy.

After obtaining a bankruptcy discharge, you will not be eligible for another Chapter 7 bankruptcy for eight years. So, for some creditors, this actually makes you a better risk, since bankruptcy is no longer an option. Lastly, consider getting other new credit options when working towards new credit after declaring bankruptcy in Tucson, Arizona.

EXPERIENCED ARIZONA BANKRUPTCY ATTORNEYS

Pima Constables Services

Pima County Constables serve all of Pima County, which is the 7th largest county in the nation encompassing 9,241 square miles containing over 1 million residents. Additionally, the largest city and county seat in Pima County is Tucson where nearly all of the population of Pima county is centered. Plus, the Pima County Constables are elected and serve 1 of the 10 justice precincts in Pima county. Also, Constables are licensed Arizona Peace Officers who execute court orders from county and state courts. Most often, the Pima County Constables execute orders which include: criminal arrest warrants, evictions, mental health commitments, protective orders, property seizures, and other writs.

The Pima County Constables serve the 332,350 households located in Pima County. Additionally, the Pima County Constable is an elected Peace officer of the County and their Judicial Precinct. Plus, a Constable is also the Executive Officer of the their Justice Precinct. Also, some of the other duties of the Pima County Constable’s office is to serve Civil and Criminal papers for the Pima County Justice Court, the Pima County agencies and other Pima County Departments that may need papers served and delivered. Lastly, the Pima County Constables also provide service for paperwork received from out of area courts equivalent to the level of our Justice Court.

Currently there are 10 Constables serving Pima County. Each Constable serves one of the ten Justice Precincts located within Pima County.

Constable John Dorer

Constable Phone: 520-724-5442

Court Fax: 520-724-5445

Constable Email: john.dorer@pima.gov

Constable Address: 240 N Stone Ave

Tucson, AZ 85701

Constable Esther Gonzalez

Constable Phone: 520-724-5442

Court Phone: 520-724-3171

Constable Fax: N.A.

Constable Email: esther.gonzalez@pima.gov

Constable Address: 240 N Stone Ave

Tucson, AZ 85701

Constable Jose Gonzalez

Constable Phone: 520-387-5403

Court Phone: 520-387-7684

Court Fax: N.A.

Constable Email: jose.gonzalez@pima.gov

Constable Address: 111 La Mina Ave

Ajo, AZ 85321

Constable James Driscoll

Constable Phone: 520-740-5442

Court Phone: 520-740-5442

Constable Fax: 520-740-5445

Constable Email: james.driscoll@pima.gov

Constable Address: 32 North Stone Suite #11

Tucson, AZ 85701

Constable William Lake-Wright

Constable Phone: 520-724-5414

Court Phone: N.A.

Court Fax: N.A.

Constable Email: william.lake-wright2@pima.gov

Constable Address: 2240 N Stone Ave

Tucson, AZ 85701

Constable Bennett Bernal

Constable Phone: 520-724-5442

Court Phone: 520-724-3171

Court Fax: 520-724-5445

Constable Email: bennett.bernal@pima.gov

Constable Address: 240 N Stone Ave Lower Level

Tucson, AZ 85701

Constable Thomas Schenek

Constable Phone: 520-330-2318

Court Phone: 520-222-0200

Court Fax: 520-648-2235

Constable Email: thomas.schenek@pima.gov

Constable Address: 601 N La Canada #A1

Green Valley, AZ 85614

Constable Mary C. Dorgan

Constable Phone: 520-740-5442

Court Phone: 520-740-5442

Constable Fax: 520-740-5445

Constable Email: mary.dorgan@pima.gov

Constable Address: 32 North Stone Suite #111

Tucson, AZ 85701

Constable George Camacho

Constable Phone: 520-724-5442

Court Phone: N.A.

Court Fax: N.A.

Constable Email: george.camacho@pima.gov

Constable Address: 240 N Stone Ave

Tucson, AZ 85701

Constable Michael Stevenson

Justice Precinct 10

Constable Phone: 520-878-6167

Court Phone: 520-724-3171

Court Fax: N.A.

Constable Email: michael.stevenson@pima.gov

Constable Address: 240 N Stone Ave

Tucson, AZ 85701

Tucson Bankruptcy Law Office

2 East Congress St. Ste. 900 Tucson, AZ 85701