Phoenix, Arizona Affordable Bankruptcy Law Firm

Attorneys Representing Debtors in Phoenix, Scottsdale and Surrounding Areas

Phoenix Bankruptcy Lawyer FAQS

Bankruptcy Lawyers in Phoenix, Arizona

Phoenix Bankruptcy Lawyers | Phoenix Bankruptcy Attorneys

PHOENIX, ARIZONA

The 15 urban villages in the city of Phoenix are:

Many people in Phoenix, Arizona think bankruptcy is bad or not the right choice for them, however, they have little information on exactly how it works and the benefits of bankruptcy. Bankruptcy is one of several options that people facing serious financial difficulties should consider. If you are faced with rising credit card and other debts you can no longer afford to pay because of a sudden job loss or unexpected medical emergencies you may qualify for chapter 7 bankruptcy, chapter 13 bankruptcy, or some other form of debt relief in Phoenix, AZ. If your business cannot keep up payments to your suppliers but you don’t want to close down or lay off your employees, you should consider bankruptcy.

Our Phoenix bankruptcy lawyers can help you with the following tasks:

- Determining which debts are eligible for bankruptcy relief

- Discovering what chapter of bankruptcy you qualify to file

- Finding out which assets you can keep

- Meeting Deadlines

- Payment Reminders

- Filling out bankruptcy paperwork and petitions

- Talking to creditors

Bankruptcy protection in Phoenix, Arizona is designed to provide immediate relief to those whose debts are beyond their ability to pay. There are many Arizona and federal laws established to protect people like you from creditors and it is a legal means of effectively resolving debt problems and helping you turn your life around. Call our Phoenix bankruptcy law office today to learn more about chapter 13 bankruptcy, chapter 7 bankruptcy, and your options to finding a debt free future. Our firm is highly practiced in bankruptcy law and has already helped hundreds of families in Phoenix file for bankruptcy protection. Don’t delay in finding out more about the bankruptcy process with our free initial consultation. Bankruptcy is our business! We care about our clients and are here to help.

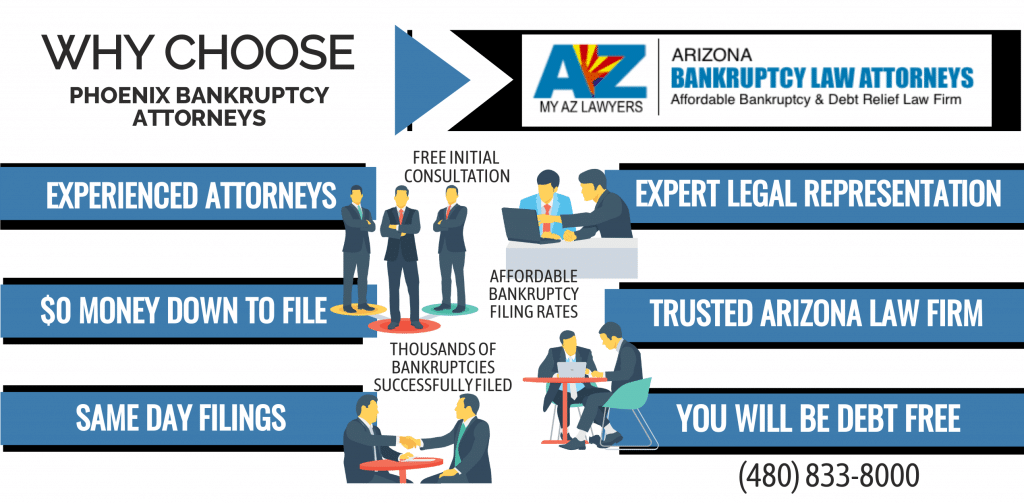

By retaining an affordable and experienced Phoenix, AZ Bankruptcy Attorney from The My AZ Lawyers, creditors will no longer be able to contact you and can turn to us for a response to their demands. By working carefully with you to develop a legal strategy you are comfortable with, our debt relief experts can begin to resolve your debt situation and get you back on firm financial footing.

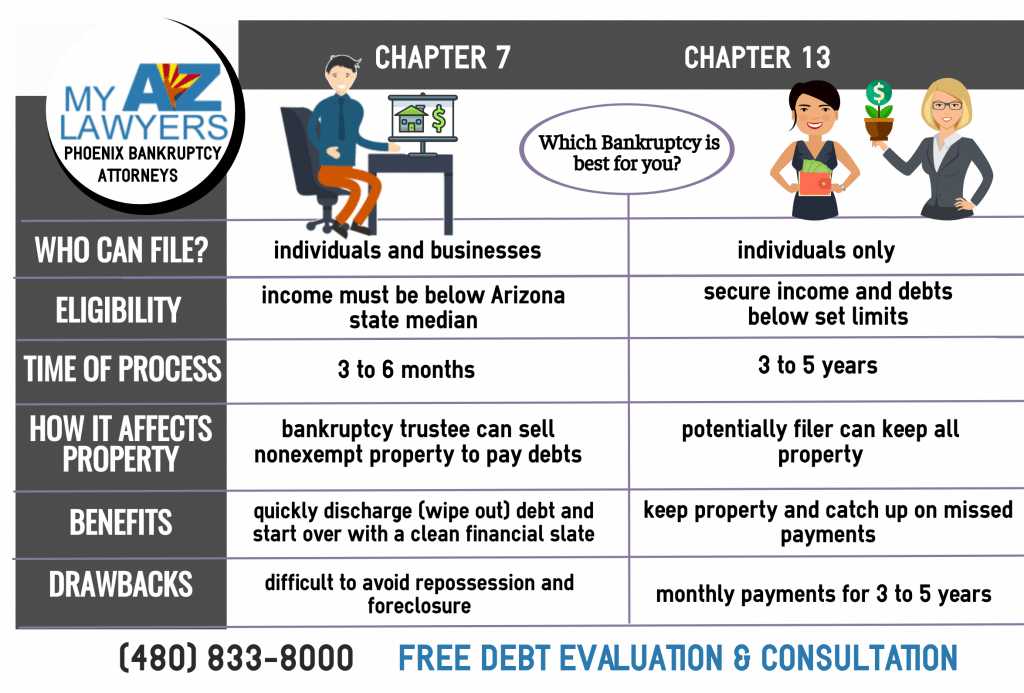

Chapter 7 and Chapter 13 Bankruptcy in Phoenix

Chapter 7 will eliminate most of all of an person’s debt. This type of bankruptcy is know as liquidation. Chapter 13 is a reorganization option. It allows a person to pay off most or all debt via a payment plan. This typically takes three to five years, and the plan is monitored by the federal bankruptcy court. There is no right solution for debt relief for everyone. If you are ready to begin the process of getting out of debt, contact our Phoenix Bankruptcy Law Firm. An experience attorney will discuss your needs, listen to your concerns, and get started immediately on a debt-relief plan for your specific case.

Our experienced Phoenix bankruptcy lawyers provide the highest quality debt relief representation to all of our Phoenix clients, individual, family, or businesses. Only a larger bankruptcy law firm such as My AZ Lawyers can accommodate and serve Phoenix with expert legal representation, but we also provide each debt relief case with the personal service, attention and responsiveness it deserves.

The legal team at My AZ Lawyers understands that Phoenix residents require the assistance and time from their bankruptcy attorney. Dedicated to the successful representation our our Phoenix clients, our Phoenix debt relief firm uses communication and personal contact in order to give each client an opportunity to address all concerns and questions that may have about their bankruptcy.

My AZ Lawyers offers a FREE one hour consultation with Phoenix bankruptcy attorney. Our lawyers offer flat fees for bankruptcy service. Ask our staff about our payment plans and financing options – we are able to provide affordable, excellent legal representation to residents in Phoenix, Arizona.Plus, we have a $0 Down bankruptcy option available to residents in Phoenix, Maricopa County, Arizona.

Bankruptcy Lawyers in PHOENIX

Schedule a FREE bankruptcy consultation and FREE debt evaluation with one of our experienced Phoenix bankruptcy attorneys. Our skilled Phoenix bankruptcy lawyers help clients with every aspect of declaring bankruptcy such as:

- ✓ Filing bankruptcy

- ✓ Chapter 7 bankruptcy

- ✓ Chapter 13 bankruptcy

- ✓ Debt relief

- ✓ Bankruptcy Assistance

Phoenix Bankruptcy Lawyers

The Bankruptcy Filing Process in Phoenix

Are you considering bankruptcy or finding out more from an attorney regarding your financial situation?

The My AZ Lawyers, our Phoenix, Arizona based bankruptcy law firm believes in affordable, stress-free bankruptcy representation. Our Mesa bankruptcy lawyers, attorneys, and staff pledge to give each client compassionate, aggressive, non-judgmental representation while filing for chapter 13 bankruptcy or chapter 7 bankruptcy in Arizona. Our debt relief specialists work with our clients to better educate them on their case to ensure they know we are right there with them. Our attorneys will guide you every step of the way while filing chapter 13 or chapter 7 bankruptcy. Our law office will help prepare our clients for ‘Life After Bankruptcy’.

We are a full service bankruptcy firm. Our bankruptcy attorneys obtain your credit reports to assist you in locating your creditors.

You Can Count on Us

You can count on us every step of the way as our experienced Avondale, Glendale, Mesa, Phoenix and Tucson legal professionals and staff will walk you step-by-step through the bankruptcy process. We will help you complete all of the complicated bankruptcy forms. Our AZ law firm will do our best to make an otherwise difficult situation as smooth as possible. Are you looking to get your bankruptcy filed for cheap? Our Phoenix bankruptcy law offices can assist you in cheaply filing your AZ bankruptcy either in one of our area bankruptcy law offices or through our Bankruptcy by Phone option. Therefore, at your free consultation with one of our Phonix bankruptcy lawyers we will work with you to decide which form of debt relief in Phoenix may be the most beneficial for your particular situation.

Low Cost Glendale Bankruptcy Lawyers

Affordable debt relief in Glendale, Arizona is only a phone call away. Therefore, are you struggling to make ends meet in Glendale or Avondale, Arizona? Plus, do calls from creditors seem to be never-ending? Or, are you scared to get your mail because of all the demanding and late bills? Whereas, if your financial situation seems hopeless, contact our dedicated Glendale bankruptcy attorneys today and find out how easy it is to get on the road to a “Fresh Start.”

Glendale, Arizona debt relief experts offer free consultations. Therefore, call us today and find out what types of debt relief are available to you and your family. Plus, let our low priced bankruptcy lawyers in Glendale explain the difference between Chapter 7 bankruptcy and Chapter 13 bankruptcy. Additionally, our Glendale and Avondale bankruptcy offices offer some of the lowest legal fees on all of our bankruptcy filings. Compare our rates, we know our bankruptcy fees are the lowest!

AFFORDABLE AVONDALE BANKRUPTCY ATTORNEY

If you feel stressed and overwhelmed at the prospect of filing for Chapter 7 bankruptcy or Chapter 13 bankruptcy, let our Avondale, Arizona bankruptcy office help you through the process of declaring bankruptcy in Arizona. Also, get the help of our Avondale law office today. Plus, our Avondale bankruptcy lawyers have several options to offer clients who are in need of debt relief and considering declaring bankruptcy in Arizona. Therefore, if you are in need of a low cost bankruptcy lawyer contact the My AZ Lawyers today.

For your convenience, our Avondale, Tucson, Glendale, Mesa, and Phoenix law firm can start your bankruptcy over the telephone. Additionally, you complete nearly your entire bankruptcy from the comfort of your home. Therefore, get your NO OBLIGATION, Free consultation at your convenience from your home or office.