Arizona Foreclosure Attorney

Stop A Foreclosure in Arizona

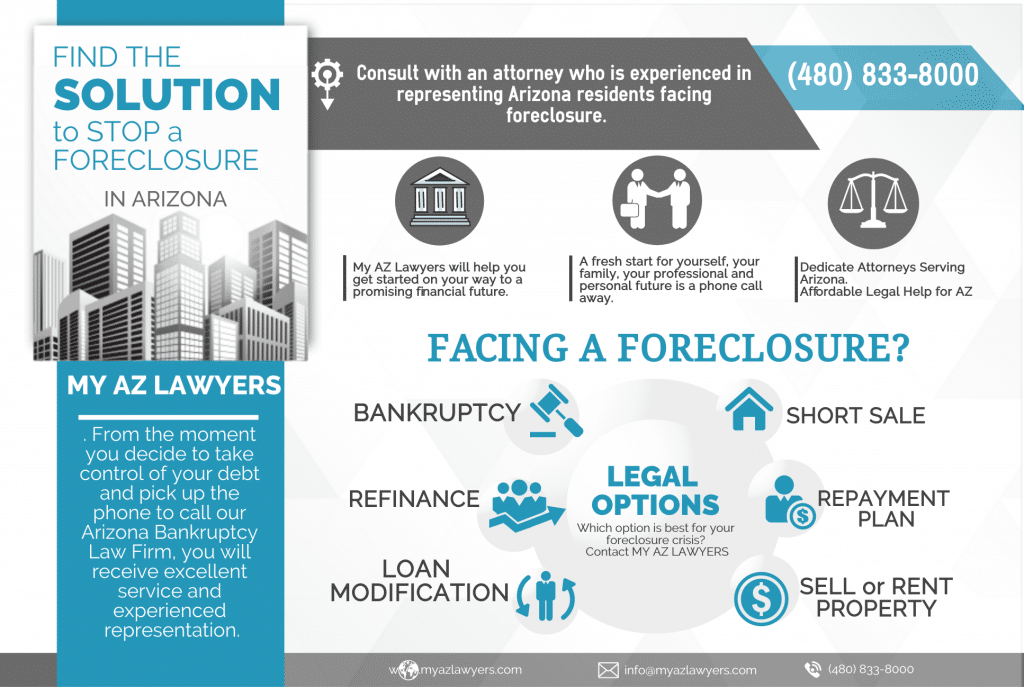

Facing a Foreclosure? What are Your Options?

My AZ Lawyers experienced attorneys can assist you if you are faced with a lender aggressively pursuing a foreclosure. Our debt relief experts can help you to understand your options and provide you with the best defense and representation to fight a foreclosure.

Each foreclosure case is unique. Our lawyers can offer solutions for your particular circumstances and foreclosure situation. What method of debt relief is the most beneficial to your case? Some solutions include a short sale or deed instead of foreclosure. Another option is filing for bankruptcy protection.

Filing for bankruptcy protection is one way to save your house from foreclosure. If keeping your home is your top priority, My AZ Lawyers debt relief team can help you understand the law. Armed with an experienced attorney and the information you need to make the best decisions for your situation, you will be able to successfully resolve your financial crisis.

ARIZONA FORECLOSURE FAQs

Arizona Homeowners facing Foreclosure

Many individuals in Arizona have felt the effect of a dismal housing market in Phoenix, Mesa, Gilbert, and Chandler. When unable to make monthly mortgage payments, a lender may take swift legal action to collect the debt. If you feel you are falling behind on house payments and cannot seem to get ahead, or if you are facing a foreclosure, you are not alone. Don’t lose hope. Instead, seek the help of an Arizona foreclosure attorney who will evaluate your case and get you back on track. If your credit isn’t good, if you are feeling that a foreclosure is looming and you want to take control of the situation, you have options that will help you navigate the foreclosure process.

Options to Avoid a Foreclosure

Choosing to work with a debt relief expert at My AZ Lawyers will make a significant difference if you need to avoid a foreclosure. Our law firm has a reputation for successfully helping Arizona residents facing foreclosure. The team of professionals at our law firm will discuss your options and use their experience and expertise in Arizona Bankruptcy Law to help you stop a foreclosure.

Listed below are some options that may help:

• Short Sale

A popular option used for avoiding a home foreclosure, short sale will allow you to get out of your mortgage crisis and limit the damage to your credit rating. After a short sale process, you may be able to apply for a new loan in 24 months. If a home is foreclosed, you may not be able to take out a loan for five to seven years. To be eligible for short sale, you must prove financial hardship, the amount of debt is more than the market value of your investment, and your monthly income is less than your expenses. Contact My AZ Lawyers if you have further questions about how a short sale works in Arizona.

• Filing for bankruptcy

Filing bankruptcy in Arizona is an option to stop foreclosure, but proceed with the legal advice of an attorney. Consider this solution if you have other debts as well as a mortgage.

• Mortgage Modification

A lender sometimes will allow a modification. This means you wish to change mortgage so that the payments will be more manageable for you. The modification would be subject to the approval of the lender, and may not change the fact that the total loan is still underwater.

• Reinstatement

Possibly a difficult option if you currently cannot keep up with payments, but a reinstatement includes paying the debt amount with late fees to the lender after the due date. This would allow the mortgage to be reinstated until the foreclosure.

• Rent your house

If you can rent your home for the amount of money to cover the mortgage payment, you could consider renting your property. If repairs are needed to achieve this, think about how the cost to repair may exceed the benefit of renting for a needed price per month. Obviously, if you are not willing to be in a landlord position, this option may not be suitable for your needs.

• Repayment Plan

A repayment plan can help you stop a foreclosure in Arizona because the lender allows you to catch up on missed payments over a period of time. You repay the lender along with the current mortgage payments. A lender needs to approve of this option.

• Sell your property

Maybe it would be in your best interest to sell the property if you have enough equity left. This would not be the best option if you owe ore than the current value of the property.

• Refinance

Arizona law does allow you to apply for a loan to repay a mortgage. You must meed eligibility requirements for a new loan. It may be difficult to get a refinance if you have a record of missed loan payments.

• Deed-in-Lieu of Foreclosure

Deed-in-lieu needs the approval of the lender before beginning the process. Deed-in-Lieu of foreclosure allows you to vacate the property and return the property to the lender. This may still have a great impact on your credit rating and make it difficult to get a future loan.

The most important thing to understand if you are facing foreclosure is to consult with an expert Arizona foreclosure attorney. With all the options available, finding the best means to a successful financial future is an important priority. My AZ Lawyers have helped homeowners in Arizona faced with foreclosure, and our firm can give you professional, experienced representation you need.