Glendale Bankruptcy Lawyers

Low Cost Bankruptcy Attorneys in Glendale, Arizona

Another benefit of our Glendale Debt Relief lawyers is the fact that you get to work with your bankruptcy attorney throughout the bankruptcy filing process. However, while many Glendale Bankruptcy Lawyers don’t ever meet directly with their clients, our Glendale debt relief team at My Arizona Lawyers meet with every client personally. Additionally, our attorneys assist the clients every step of the way. Plus. if you are looking for hands on service from your bankruptcy attorney, look no further.

Glendale Debt Relief Experts

Our Glendale debt relief experts can fight for you and your family if you are facing the loss of your home in a foreclosure defense. We also assist in ending wage garnishment, stopping repossessions, tax debts, freezes on bank accounts, and filing joint bankruptcy. Any financial situation can usually be resolved with the help of our Glendale bankruptcy law firm. Our Glendale debt relief experts will carefully analyze your financial situation and find the best solution for your problem, whether it is bankruptcy or another form of debt relief.

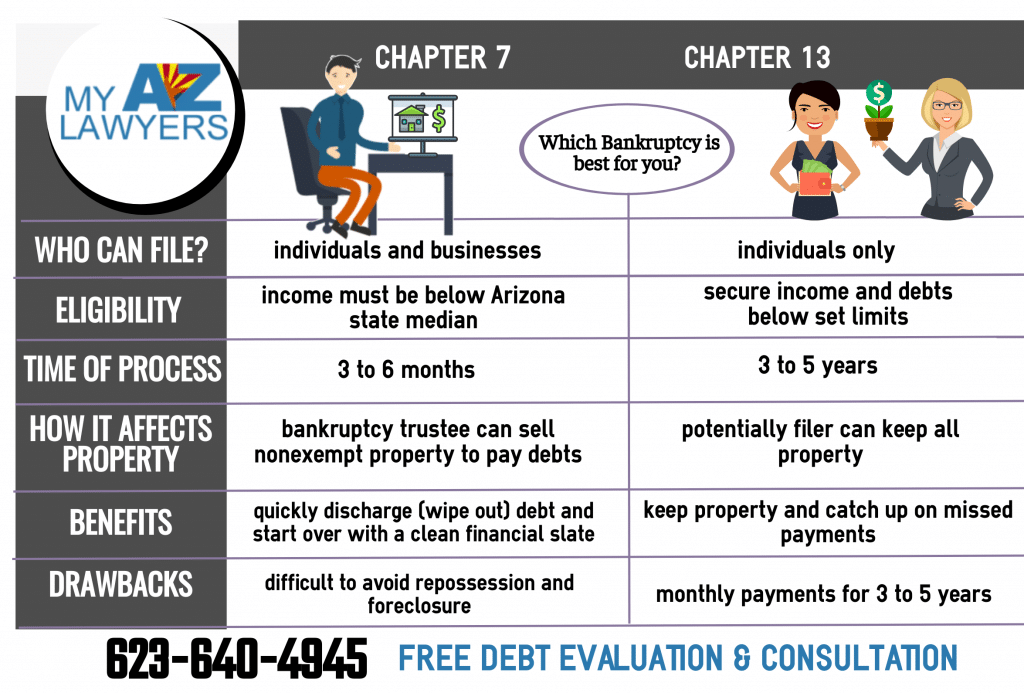

If you or your family is experiencing financial problems that have become unmanageable, or nearly so, you may be wondering if filing for bankruptcy in Glendale, AZ is the correct course of action for you. In order to come to the best decision, you must first take a very close look at your financial situation. Taking an honest look at your finances may be an uncomfortable task to undertake, but it is vitally important if you are to avoid making the wrong choice. Our experienced Glendale bankruptcy attorneys can assist you with evaluating your current financial situation as our lawyers will have strong insight into whether your circumstances call for filing chapter 7 or chapter 13.

GLENDALE BANKRUPTCY FREQUENTLY ASKED QUESTIONS

When deciding if bankruptcy is the answer, ask yourself certain questions, including:

- Is your debt load such that it is unlikely you will be able to pay it off in the near future?

- Also, Do you regularly fail to pay certain bills, or pay them after they are already due?

- Plus, Are you borrowing money from family and friends that you can’t repay?

- Are your creditors threatening to take legal action against you?

- Additionally, Do you worry about having your car repossessed or your home foreclosed upon?

- Plus, Are you not wanting to answer your home phone or cell phone as it is always a bill collector?

- Also,Have you borrowed money from a short term lender with astronomical interest rates?

- Therefore, Are you giving up certain basic necessities in an effort to make ends meet?

- Are you bouncing checks?

- Do you have one or more payday loan?

Recommended Glendale Bankruptcy Attorneys

If you are experiencing any of these detrimental financial situations, or money troubles like this, it is recommended that you contact MY AZ LAWYERS right away. Thus, our Glendale bankruptcy law firm believes in low cost, stress-free representation. Also, our Glendale bankruptcy lawyers and staff pledge to give each client compassionate, aggressive, non-judgmental representation while filing for chapter 13 bankruptcy or chapter 7 bankruptcy in Arizona.

Our recommended Glendale bankruptcy attorneys can help you with your current financial situation, stop wage garnishment and we will put a stop to the constant creditor calls. Additionally, our experienced debt relief experts can even (in most cases) delay or stop a trustee sale. Thus, please contact our Glendale bankruptcy lawyers to start you on the road to a “fresh start“.

Additionally, our Glendale, Arizona bankruptcy attorneys offer free initial consultations and case evaluations. Plus, we have some of the most affordable legal rates in Glendale, maricopa County and all of Arizona. Also, we offer payment plans, zero down bankruptcy filings, night and weekend appointments. Plus, a no hassle, no pressure, no obligation, FREE consultations for you; either over the phone or in one of our Glendale area bankruptcy law offices.

Bankruptcy by Phone in Glendale, Arizona

Our bankruptcy law firm in Glendale, AZ (for your convenience) can start your bankruptcy over the telephone. You can complete nearly your entire bankruptcy from the comfort of your home. Our Glendale bankruptcy lawyers are proud to offer the people of Glendale, Arizona the option of “Bankruptcy by Phone”. Thanks to today’s technological advancements, our attorneys can assist you in completing the entire process of declaring bankruptcy in Glendale.

Completing the majority of your Glendale bankruptcy over the phone allows clients who choose to use our “bankruptcy by phone” program to attend their bankruptcy hearing and never have to step foot in our bankruptcy law office if they choose. For clients who prefer an in-person or in-office approach, we are able to accommodate them in the traditional bankruptcy attorney role.

Free Debt Evaluation with our Glendale Bankruptcy Team

Bankruptcy by phone allows you to get your NO OBLIGATION, free debt evaluation where it is convenient (at home, at work, on your commute). During your free debt evaluation by phone, our legal professionals will advise you of your debt relief options. Regardless if you have many or few options, we will evaluate your individual situation and discuss the details of all of the debt relief options available as you seek debt relief assistance in Glendale, Arizona. Find out which debt relief options may be the best for you and your family.

Our law office has helped hundreds of people in Glendale, Maricopa County, and throughout Arizona file for bankruptcy protection via our bankruptcy by phone option. Therefore, if you feel stressed and overwhelmed at the prospect of filing for Chapter 7 or Chapter 13, let our Glendale bankruptcy lawyers help you through the process of seeking bankruptcy protection. Additionally, our professional, compassionate, and helpful approach will be a great help to you as our Peoria and Glendale bankruptcy lawyers assist you with debt relief assistance.

Therefore, get your NO OBLIGATION, free bankruptcy consultation at your convenience, from your home or office. Whereas, Arizona bankruptcy is our business. Also, our debt relief team looks forward to assisting you. Lastly, Contact our low cost Bankruptcy Lawyers today.

Chapter 7 and Chapter 13 Bankruptcy in Glendale, AZ

While Chapter 7 in Glendale, Arizona is a lot faster achieving a “fresh start” (usually 5 to 7 months start to finish), Chapter 13 bankruptcy is a longer process. Plus, there is a re-payment period in a Glendale chapter 13 bankruptcy. Also, the typical chapter 13 repayment period is 3-5 years. However, the length of your chapter 13 bankruptcy depends entirely on your specific situation. Sometimes, your bankruptcy case can be longer and sometimes shorter.

A “341 Hearing” or a “Meeting of Creditors” is usually the only court hearing that you will have to attend in a Glendale chapter 7 bankruptcy. Plus, this 341 hearing is usually a short hearing, lasting usually 10-20 minutes.

Also, in a chapter 13 bankruptcy there will be a few hearings that are usually very quick and informational. Also,in a chapter 13 the bankruptcy court sets your payments. Additionally, you are required to make those Ch 13 bankruptcy payments over the term of the Chapter 13, (usually 3-5 years). Thus, 0ur Glendale bankruptcy lawyers will be with you at every court hearing as you work through the process of filing for either chapter 7 bankruptcy or chapter 13 bankruptcy in Glendale, Arizona.

Glendale Chapter 7 and Chapter 13 Bankruptcy Attorneys

Filing chapter 7 bankruptcy or chapter 13 bankruptcy in Glendale, Maricopa County, and throughout Arizona is this country’s consumer protection law and is a perfect debt remedy for these challenging economic times. Therefore, in the hands of experienced Glendale bankruptcy lawyers, debt relief law offers many different avenues to help consumers. Thus, determining the best solution for you will be based on your financial goals and legal options. Lastly, Debt consolidation, Zero Down Bankruptcy, Chapter 7 bankruptcy, and chapter 13 bankruptcy are solutions available to most consumers in Glendale, even under the 2005 bankruptcy law revisions.

Benefits of Filing Bankruptcy in Glendale, Arizona

Many people believe filing for chapter 7 bankruptcy or chapter 13 bankruptcy has a negative connotation. Because of the negative perception of even the word – bankruptcy – many shy away from filing for the debt relief they so badly need. Therefore, our Glendale bankruptcy attorneys and staff not only want to help you find financial freedom, we want to highlight the many benefits that declaring bankruptcy can bring you. Thus, contact our dedicated bankruptcy lawyers for more information regarding debt relief in Glendale, Arizona.

There are many benefits that filing bankruptcy could provide to you. Also, our Glendale bankruptcy law office understands that your situation may be weighing heavy on your mind. Plus, financial hardships and creditors may be weighing you down, but we can assist you. Additionally, if you are in need of a trusted lawyer who can provide you with representation and information about the various benefits that filing can have for your personal situation, do not hesitate to contact a Glendale bankruptcy attorney from our team.

Directions To My AZ Lawyers in Glendale, Arizona

Directions From Downtown Glendale To Glendale Bankruptcy Attorneys

START: Downtown Glendale, Arizona

2. Turn right onto N 91st Ave (signs for Arizona101 Loop N) 0.2 mi

3. Take the ramp onto AZ-101 Loop N 8.3 mi

4. Take exit 20 for 51st Ave 0.3 mi

5. Merge onto W Beardsley Rd 413 ft

6. Turn left onto N 51st Ave 0.2 mi

7. Turn right onto W Tonopah Dr 223 ft

8. Turn right

Destination will be on the left

END: MY ARIZONA LAWYERS

Glendale Bankruptcy Lawyers

20325 N. 51st Avenue, Suite 134

Glendale, Arizona 85308

Office: (623) 640-4945